HAPPY HOLIDAYS!

I would like to wish everyone a Merry Christmas and Blessed New Year! May the joy of this holiday season warm your heart and home.

Rep. Tipsword: May the Joy of this Holiday Season Warm your Heart and Home – YouTube

DISTRICT OFFICES ADDED

I am thrilled to announce the expansion of our services. In addition to the main District Office in Pontiac, we have recently opened constituent services offices in El Paso and Metamora. The El Paso office is located inside City Hall at 125 E. Front St., and the Metamora office is located on the Square at 101 E. Partridge St.

We hope to better serve our residents and constituents with the expansion to three offices in District 105. The phone number for the El Paso and Metamora offices is 309-370-6235. We will be posting office hours for these offices soon.

AROUND THE DISTRICT

I attended a recent El Paso City Council meeting where I spoke about our new District Office opening in town. Thank you to the El Paso Journal for covering the story and for providing the picture above (Photo credit: Jennie Kearney). Also, for readers of the El Paso Journal, my debut column is expected to be included in the January 1 edition. I look forward to connecting with you on a regular basis in that publication.

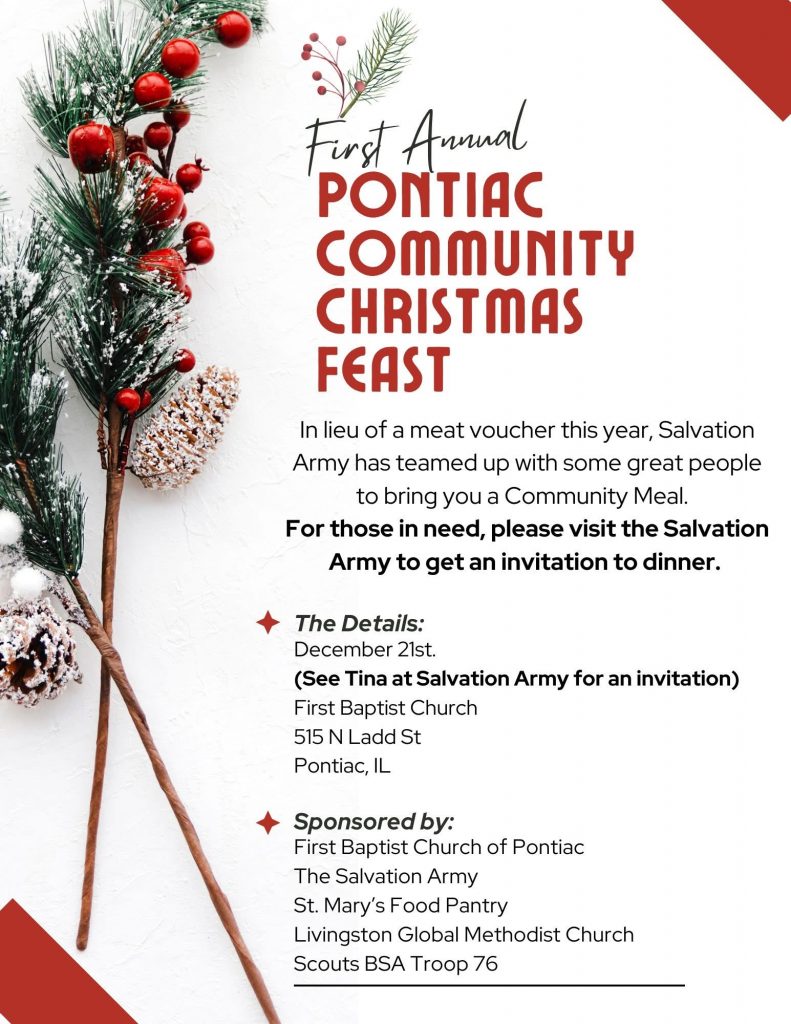

Our dedicated volunteers in District 105 are teaming up to bring those in need a Free Christmas Feast Dinner on Saturday, December 21. Please see the details above. Thank you to the First Baptist Church of Pontiac, the Salvation Army, St. Mary’s Food Pantry, Livingston Global Methodist Church, Scouts BSA Troop 76, and everyone else involved with this wonderful gesture of community support.

The McClugage Bridge, which carries U.S. 150 over the Illinois River between Peoria and East Peoria, partially opened to traffic on December 19. The area remains an active work zone, so please drive safely and allow for extra time.

McClugage Bridge open for two lanes of traffic on December 19

SCOTT’S LAW

Remember to slow down and move over if it is safe to do so when passing any vehicle with hazard or emergency lights activated.

Illinois State Police squad car hit while at scene of another crash in Downers Grove – CBS Chicago

MINIMUM WAGE

The minimum wage in Illinois is increasing by $1 on January 1. Wages for tipped workers and youth workers are also being adjusted.

30747-121724-12.17.2024-idol-2025-minimum-wage-increase-002.pdf.pdf

SCAMS

Text and email scams are on the rise and especially prevalent during the holidays. Here are some common scam tactics you should look out for.

A Scam Text Ends Up Costing Illinois Resident Almost $30,000

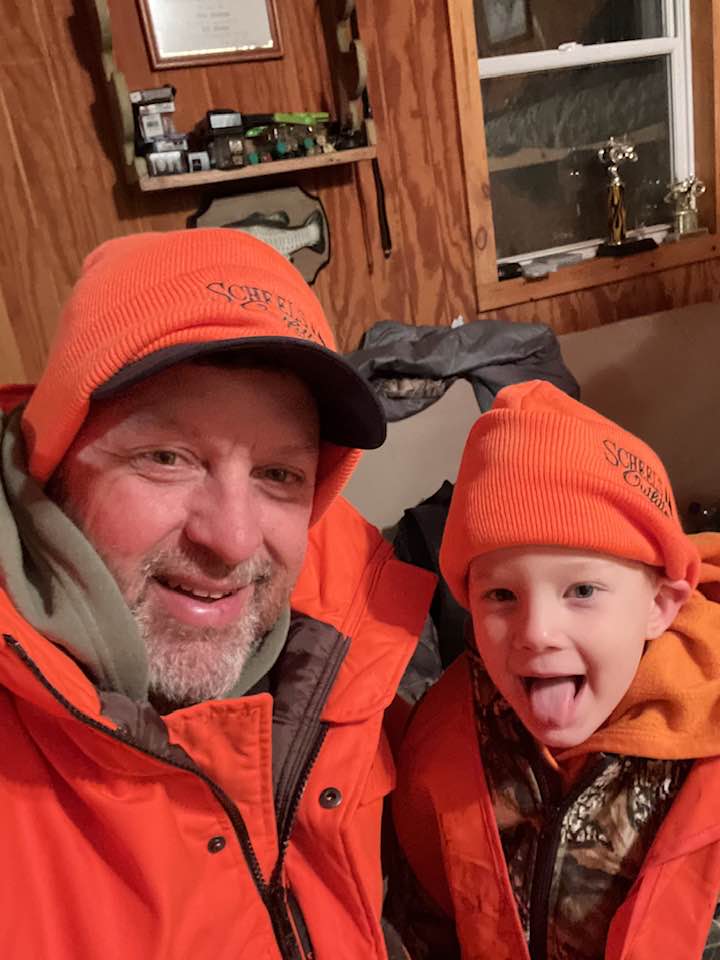

DEER HARVEST

Illinois hunters had a successful deer season, harvesting 6,000 more deer this year than last year.

More than 82,000 deer harvested during Illinois firearm deer season | News | wsiltv.com

PENSIONS

Illinois’ unfunded pension liabilities at near-record $143.7 billion. The Commission on Government Forecasting and Accountability (CGFA), in its 2024 Special Pension Briefing, reported that Illinois’ unfunded pension liabilities totaled more than $143.7 billion at the end of Fiscal Year 2024 (June 30, 2024). This near-record figure is an increase from the equivalent $142.2 billion figure posted in the previous fiscal year and is only slightly below the all-time-record pension deficit of $144.2 billion posted in FY20.

The five State pension systems covered by the report cover the future costs of non-healthcare retirement benefits payable to vested public-sector employees in the following categories: (a) public school teachers and educators, (b) state employees, (c) employees of Illinois colleges and universities, (d) the judges of the circuit, appellate, and Supreme courts, and (e) members of the Illinois General Assembly. The $143.7 billion deficit reflects the collective unfunded pension liabilities of all five systems. The largest share (more than half of the total) is the $82.9 billion in unfunded liabilities posted by the Teachers Retirement System. TRS is the pension system that pays retirement benefits to teachers and other educational personnel in school districts throughout the state.

CGFA’s report indicates that none of these five systems have even one-half of the funds they will need to have in hand, based on generally accepted actuarial standards, to meet their future contractual obligations. The five systems are funded at ratios ranging from 46.3% (TRS), to only 24.6% for the pension system that supports retired Illinois lawmakers and legislators.

It is important to note that an “unfunded pension liability” is a forward-looking actuarial and accounting concept. It reflects the funds that each pension system actually has on hand for investment returns, to which are added an actuarially-sound estimate (based on current global economic patterns and interest rates) as to likely future investment returns; these assets are balanced against the likely total of benefits that will have to be paid out, based on future life expectancies, to current and future beneficiaries that are vested in the system. If the quantity of expected future benefits exceeds the quantity of expected future assets, the pension system must post an unfunded pension liability total. All five Illinois State-managed pension systems have made this calculation and posted these liabilities, and CGFA has compiled these five data sets to generate this week’s report.

These unfunded pension liabilities are debt-equivalent moral obligations of the State of Illinois and its taxpayers. If pension debts pile up, the State’s credit rating risks downgrades. The State of Illinois must sell debt whenever it needs to make serious investments in its roads, bridges, and other public capital infrastructure. Illinois currently has a single-A credit rating with all three major New York-based credit rating agencies, which is well below average for large public-sector debt issuers (the rating system goes up to ‘triple-AAA’) and is lower than the credit rating posted by most U.S. states.