The House adjourned for the summer at about 5:00 Wednesday morning, just a couple of hours after the majority party pushed through a $53.1 billion, 3,000 + page state budget for Fiscal Year 2025, the largest in Illinois history. Here’s what you need to know:

- This budget is a whopping $2.6 billion more than last year’s enacted budget. Over the last four years, the Democrat-controlled General Assembly and Governor JB Pritzker have grown state expenditures by more than $13 billion.

- To balance their record spending budget, Democrats voted for $1 billion in tax hikes on things like video gaming and sports gambling.

- Democrats included another $1 billion in funding for the Illegal immigrant crisis they have created (healthcare, welcome centers, and other services).

- The majority party was also sure to include a 5% pay increase for legislators. This is the 3rd raise in two years and makes us the 3rd highest paid legislature in the country.

- In FY25, more than $86 million in General Revenue Funds and $147 million from other state funds will be appropriated for projects associated with or in members’ districts.

- The budget also relies on close to $1 billion in budget gimmicks that hide the true cost of this spending plan going forward.

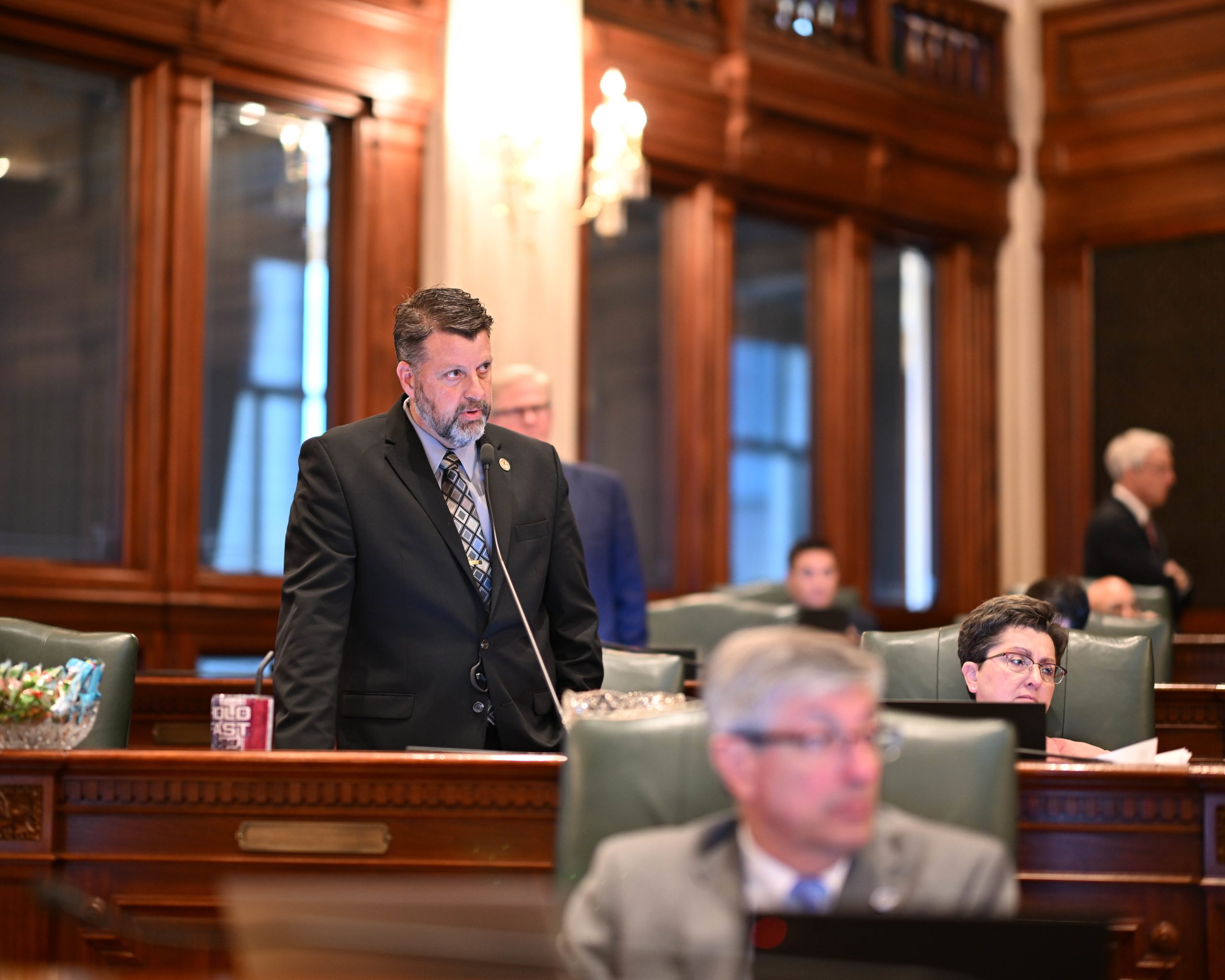

The budget crafting and voting process is almost as frustrating as the budget itself. Not a single Republican was brought to the table to negotiate the budget on behalf of the millions of Illinoisans we represent.

When the final vote was called, once again Democrat staff was voting for members who were not on the Capitol complex. This is a practice that happens far too often. We called them out, and were successful in removing some votes, but in the end the budget passed with the minimum 60 votes after the majority party voted to change their own rules and brow beat enough moderate Democrats to vote for this progressive spending plan.

Illinois families deserve so much better than this.

There is a Better Way Forward

Republicans have been ready to come to the negotiating table to ensure taxpayers are protected in the budget process.

Our side of the aisle has prioritized tax relief, no new taxes, holding the line on spending, providing adequate education funding, tackling agency waste and mismanagement, improving ethics laws, and improving public safety. These are priorities worth fighting for, and we will continue to do just that.

We Need Meaningful Property Tax Relief, Not Another Study

Governor Pritzker could have another chance to create a task force to conduct a study of Illinois’ property tax system after a measure advanced both chambers despite some saying it will be a waste of time.

State Rep. Mary Beth Canty, D-Arlington Heights, defended Senate Bill 3455 to create a task force including members from the Illinois Department of Revenue and the Department of Commerce and Economic Opportunity to conduct a study to evaluate the property tax system in the state.

It sounds good…but a similar study was conducted after being created in 2019. Not only did no tax relief happen as a result of that study, Representative Canty didn’t even have the results to share with us during the debate.

The bottom line is that Illinois has among the highest property taxes in the nation, and it’s one of the top reasons families and businesses are fleeing to friendlier states. We have already studied the issue. Now we need to pass real, meaningful relief to help our families.

Metro Illinois jobs report for April 2024

April 2024 unemployment was significantly higher than this statewide figure in certain Illinois metropolitan areas. The unemployment numbers were 5.3% in metro Danville, 5.7% in metro Decatur, 5.7% in metro Kankakee, and 5.9% in metro Rockford. Regions of Illinois with significantly higher unemployment than the statewide average tend to be metro areas with a traditional orientation towards manufacturing and industry, including so-called “heavy industry.”

Don’t Forget to Claim Your Cash Next Week!

Don’t forget to mark your calendar for our I-Cash Event with the Treasurer’s Office next Tuesday, June 4! From 10:30am to 1:00pm Treasurer’s Office staff will join us in our district office in Pontiac to check unclaimed property records for you to see if you can claim your cash, and then help you file a claim. Don’t miss out!